Introduction

The Commodity Research Bureau's (CRB) Index tracks the prevailing pattern in the market for commodities. The Commodity Research Bureau (CRB) has been a trusted and prominent hub for market participants worldwide to gain access to fundamental data, tools, and commodities research for nearly a century. The CRB has played this role. Since Barchart acquired the Commodity Research Bureau in 2001, we have been delighted to continue providing these services using our improved commodity product family. " This is how Barchart's Chief Executive Officer, Mark Haraburda, describes it. "Due to consolidating the CRB products under commodity, users will now have easier access to our streamlined service offering. Some of the products that were previously only available through CRB are now also offered through commodity.

BLS Cash Indexes

The COMMODITY BLS Commodity Price Indexes are going to become a widely used private standard for gauging the movements of prices for commodities on a global scale.

DataCenter

Soon, the commodity price history database included in the commodity by Barchart product line will be among the most extensive and detailed worldwide. Access to global end-of-day and commodity price data can be had by businesses in a streamlined, expedited, and dependable manner, thanks to DataCenter. The CRB Yearbook, which has been a valuable resource for the commodity market since it was first published in 1939, will hereafter be referred to as the commodity Yearbook. This annual publication contains statistics and economic data for the world's most significant commodities as of the previous year. The current and historical fundamental data CRB holds are being migrated to the improved commodity Stats API service. This process is currently underway.

How Does the Commodity Research Bureau Index (CRB) Work?

The CRB Index is an all-encompassing price index for the commodity market. The Commodities Research Bureau is the organisation that determines the value of this Index, and Thomson Reuters and Jefferies are the companies that make it public.

Calculation of the Commodity Price Index

These figures are weighted 12-month averages of the total quantities of each commodity exported to a foreign country over the previous year. For example, the amount of coking coal used in the calculation of the December 1992 Index was the average monthly cargo of coking coal that was exported during the twelve months beginning in January 1992 and ending in December 1992. Consequently, the monthly fluctuations can be reduced, and the variable export composition can be accommodated.

Some features of the Index

Moving Weights

The Reserve Bank Index is computed using a weighting scheme of the Paasche type, with current-period weights that change over time to reflect shifts in the composition of the export sector. These weight adjustments will have effects distinct from those that the rebasing discussed earlier will have. In contrast to a variety of other price indices, where weights are held steady between rebasing, such weights are free to fluctuate over time for the CPI and, in fact, do so regularly.

Currency Denomination

The Index is published using three distinct base currencies: the United States dollar, the Australian dollar, and special drawing rights. When deciding which Index to use as a focal point, you should consider the current problem. As a result of the fact that the vast majority of commodity transactions that take place on global markets are conducted in US dollars, the US dollar index is of significant interest. However, shifts in the value of the US dollar about the values of other major currencies may affect the prices of commodities expressed in terms of the US dollar.

Why Does the Commodity Research Bureau Index (CRB) Matter?

A common sign of inflation is a general upward trend in the prices of goods and services. On the other hand, bond prices have an inverse correlation with inflation, which means that they typically move in the opposite direction of commodity prices. Traders in bonds and commodities keep a close eye on the Commodity Research Bureau (CRB).

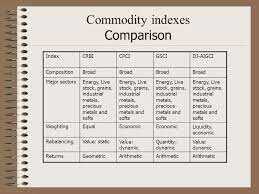

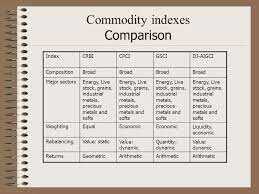

Comparison with Other Indices

Several other indices, in addition to the value of Australia's exports, are used to track the value of those exports. For example, the Australian Bureau of Statistics (ABS) export price deflator considers the total dollar value of all merchandise, not just commodities, exported from Australia. A very close correlation between the RBA Index in Australian dollars and the commodity components of this deflator.

Commodities as an Asset Class

The traditional approach to asset allocation places emphasis on equities (also known as stocks), fixed income (also known as bonds), and cash equivalents (money market instruments). The asset class mix that financial experts use recently saw the addition of commodities as a relatively new component. Opinions amongst professionals in the financial sector regarding whether or not they contribute value to a portfolio are divided, but the diversification, inflation protection, and absolute returns that they offer to lead many to believe that they do. Some see commodities in the asset management industry as an asset class lacking diversification and highly susceptible to volatility. According to the CFA Institute's research, the most exposure can be found in passive indexes that only invest in long positions. Consequently, indices of the prices of commodities, such as the CRB, are of tremendous assistance to portfolio managers.

Conclusion:

The CRB Index is widely acknowledged as a standard to measure performance against the global commodities markets. The Commodity Price Index (CRBI) is a metric that was developed to isolate and reveal the directional movement of prices in total commodity trades, as measured across multiple commodity sectors. It was created to determine how prices in total commodity trades are moving. In 1986, the CRBI surpassed all other contracts on the exchange to become the most closely followed contract there; to this day, several brokers continue to back commodity indices that record changes in the prices of various commodities.