Introduction

A high-risk option strategy, the naked, is also known as a covered call. If an investor doesn't own the underlying security, they can't sell or write call options on it. The seller hopes the stock price will not rise before the call expires. Trades are more secure when they buy call options on stocks they already own. The net investment of the trader is protected if the stock price rises significantly. This is an example of a hedged position, where the long stock position grows while the short call option position shrinks as the stock price rises. The "covered call" position is a lower-risk investment strategy.

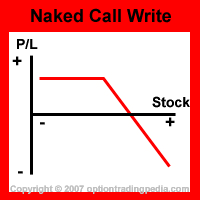

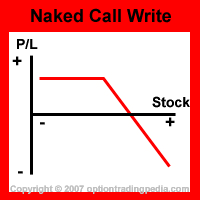

On the other hand, naked call writing is a speculative investment. If the asset you are trading is in or near the market at the expiration time, the premium is retained, but you also have the potential to lose infinitely. You can learn more about the naked call, including its work, the risks involved, and other factors.

Naked Call Writing: What Is The Process?

Naked call writing refers to the practice of marketing a call choice without holding the underlying protection. When you're long a call, you have the opportunity to buy the asset at any price you like. When a counterparty sells a call, they are considered to be "short" the call, and their position may be secured by the underlying asset's ownership (covered call) or unsecured (naked called).

Naked calls can be used to reduce the length of a phone call. This is typically a more advanced level of options trading because of the inherent risk. If the account holder does not meet specific requirements, the broker may not even authorize the transaction (such as having a substantial margin or years of experience).

When you make an uninvolved call, the broker is informed that you want to "sell to open" a call position. Because there is no underpinning position, if the calls are in-the-money, you'll have to buy an asset at market value and then sell it at the strike price.

How Do Naked Calls Work?

If the option is exercised, the buyer must purchase the stock that is the basis of the option at the current market rate, which makes using a naked-call strategy extremely risky. If the option is exercised, the owner will likely lose a significant amount of money because stock prices are boundless.

Risks of Naked Writing

Most brokers will require you to have prior options trading experience and meet specific financial requirements before allowing you to trade naked options. A minimum balance is also necessary on your account. If your position goes against you, ensure you have enough money in your account to cover the initial margin. Always check with your broker about margin and account requirements before trading.

For the duration of the transaction, there is a risk of assignment. They are typically assigned when options are in-the-money, or there is a benefit to exercising for an equity payout. Any time up to the expiration date before an option's writer is assigned possible. When writing call options, the margin requirements are typically lower than those in direct trading. Investors can make "more" call options than they would by directly shorting the stock market.

It is common to use a margin account when writing naked options, but a put that can cover the entire contract value and be secured with cash can also be noted. The implied volatility heavily influences the cost of an offer. As stock prices begin to fluctuate widely, the implied volatility may rise substantially. Rising suggested volatility may have a significant impact on your margin requirements.

Taking a position like shorting stocks may be possible by calling naked options with a different risk profile. Making a naked call is complex and requires a lot of self-control. Even though naked call options carry the same risk of unlimited exposure, they can start with a premium for the opportunity to provide a safety net. Call options are written naked.

Conclusion

Until the contract expiration date, you agree to hand over long stocks to the buyer at any time until you issue naked calls. A naked call is a risky options strategy because the stock could rise in value. The naked call is an aggressive strategy that aims to recoup the option's premium. Because of the dangers, many investors use higher strike-rate call options or equity to protect their bets against the downside.