Introduction

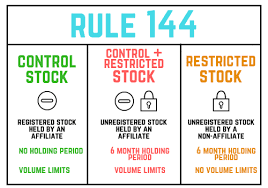

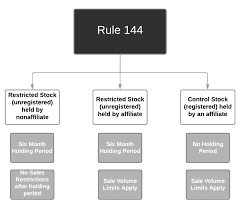

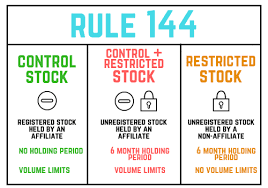

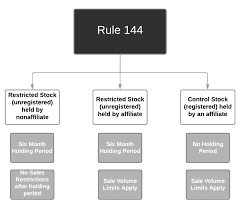

What Is Rule 144? Rule 144 authorizes the public resale restricted and controlled securities under particular conditions. Read this first if you own securities subject to restrictions or controls and are considering selling them. In addition, it describes how one can get a damaging urban legend disproved. Rule 144, which regulates the terms and conditions under which restricted, unregistered, and controlled securities may be sold or resold, is enforced by the Securities and Exchange Commission (SEC) of the United States of America.

The requirement that dealers of securities on public markets register their offers with the Securities and Exchange Commission might be waived if certain conditions are satisfied (SEC). This rule applies to all sellers, not just those who issue securities, those who underwrite securities, or those who deal in securities. Rule 144 provides an exemption and makes it possible for restricted or controlled securities to be resold on the public market as long as certain requirements are satisfied.

Why Is It Necessary to Follow Rule 144?

Depending on your role as an employee, business owner, or investor, you can have "restricted" or "control" securities. These are examples of common situations for these: In exchange for monetary compensation, the worth of one's knowledge is taken into consideration. in return for the preliminary cash, commonly called "seed money." Rule 144 provides an exception so that you are not required to register the sale of securities with the SEC. This exemption is typically required in the context of mergers and acquisitions (M&''A), referred to as "M&''A." The ability to resell restricted stocks acquired through private placements results in an increase in the value of those securities compared to what it would be if they were kept permanently.

What Are the Requirements to Play Under Rule 144?

Keeping track of time Before you are allowed to sell restricted securities on the open market, you must wait until the restriction ends. Suppose the securities were issued by a "reporting company," which is a corporation obligated to file reports per the Securities Exchange Act of 1934. In that case, they must be held for a minimum of six months before being sold. If the issuer is not subject to any reporting requirements, you must hold the securities for a minimum of one year. The applicable holding period does not start until the securities have been purchased and the full purchase price has been paid.

Information that the general public can access at this time. For a transaction to occur, there must first be up-to-date and pertinent information about the issuing corporation readily available to the general public. If a corporation is "reporting," this indicates that it has complied with all of the requirements imposed upon it by the Securities and Exchange Commission regarding submitting periodic reports.

The Securities Exchange Act of 1934.

Volume Trading Formula. If the class being sold is listed on a stock exchange, a connected party cannot sell more than 1% of the outstanding shares or more than 1% of the average weekly trading volume during the four weeks before filing the Form 144 notice of sale. If I satisfy all of the requirements outlined in Rule 144, does that mean that my shares automatically become "free trading"? Rule 144 is a transactional exemption that enables restricted shares to be traded on the public market once certain requirements have been satisfied. Although the requirements might have been satisfied, this does not necessarily mean that the securities are "free trading."

Rule 144 prohibits the sale of restricted securities until the restriction legend printed on the certificate has been removed. The only entity with the power to remove the legend is a transfer agent; for them to do so, they need to get authorization from the firm that issued the security. This approval is often communicated in the form of a legal opinion letter from the legal counsel of the corporation issuing the security. It is possible that removing the limited legend or stamp from your certificate will require some time as well as the assistance of a legal professional.

Conclusion

Rule 144 is a series of regulations enacted by the Securities and Exchange Commission to regulate the distribution of securities that have not been the subject of a formal registration procedure. These regulations control private placements of securities. Under Rule 144, additional restrictions apply to trading securities owned by shareholders with a majority or controlling stake.