Introduction

What Is Equity Compensation? Employees who receive ownership in the business rather than cash pay are seen as owners by the business. Equity compensation comes in many forms, including stock options, performance shares, and restricted stock. Employees of companies that use stock options as compensation may be able to benefit from the success of the firm through appreciation of their

How Does Equity Compensation Work?

A fully vested employee of a privately owned company may sell their shares on the private market. In contrast, shareholders of a publicly traded corporation may do so on the public stock exchange. There are several situations where a company might think about providing potential employees with equitable pay. The following are illustrations of such events that might occur:

They are removing the "principal/agent" conflict when employees lack the incentives to behave as their employer would. Instead of paying employees salaries, corporations might sell them stock to save financial outlay. This frequently happens to startup companies with little resources. Businesses increasingly turn to equity-based compensation to motivate employees beyond their regular pay. The Company is better equipped to acquire and retain talented employees due to the financial ties built between the individual and the Company through equity remuneration.

Types of Equity Compensation

Stock Options

Stock options are a type of equity compensation wherein a firm gives an employee the option to buy a specific number of shares of the Company's stock at a predetermined price (the "exercise price"). The employee may become fully vested in this option after a predetermined service period with the Company.

Non-Qualified Stock Options (NSOs) and Incentive Stock Options (ISOs)

Additional forms of equity compensation include non-qualified stock options (NSOs) and incentive stock options (ISOs) (ISOs). ISOs (incentive stock options) (and not non-employee directors or consultants). The price of these options includes favorable tax treatment.

Restricted Stock

Before receiving ownership of restricted shares, an employee must pass a vesting period. Vesting may be finished in one single sum after a specific time. Additionally, vesting may take place over a variable length of time, be prorated, or be accomplished in any other manner that the management of the Company deems suitable.

What is the Value of Equity Compensation?

To find out your percentage ownership, ask your Company for the number of "fully diluted" shares, which includes stock that has not yet been issued but may be issued in the future. The Company's valuation can then determine the value of your stock compensation (harder to ascertain for private than public corporations).

What is a Restricted Stock Award?

Restricted stock awards are shares subject to a vesting schedule based on time and performance factors. This indicates that you will receive the shares free and clear once you satisfy the requirements established by the corporation. (It doesn't happen very often.) You must include the value of your shares of restricted stock as income on your tax return once they have vested.

Potential Problems With Equity Compensation

Although stock pay is popular across many industries, its complexity is frequently highlighted as a significant disadvantage. When dealing with equitable pay, there are new territories to cross regarding taxes and reporting regulations. A few of the many variables that must be considered during the design process of equity compensation include the amount of stock to award, who is eligible to participate, the length of the plan, and the date on which it will vest.

The administration of your equity plan already requires a lot of work, so adding tracking and reporting ownership changes, updating papers, rules, and procedures, communicating with stakeholders, involving your board of directors, and staying in compliance may be necessary. But a really easy solution is cloud-based, fully automated stock compensation administration software.

Benefits And Drawbacks Of Equity Compensation

To begin with, granting stock options to employees is a sensible way to raise capital for a business. Since they lack the resources to pay their employees in other ways, startups frequently use stock compensation to draw in and keep top talent. Second, stock options aid in fusing employee interests with corporate objectives. When given stock options, they become more vested in the Company's success. This makes it easier to retain employees. The Company's capacity to provide incentives raises your EVP (employee value proposition). When this happens, a company becomes a fierce rival in its sector.

However, some founders go beyond with stock awards and give away an excessive amount of the Company. The strategic planning done properly could have avoided this. According to the National Centre for Employee Ownership, 76% of employees given stock options decide to exercise them. Consequently, most of your employees will take stock options if you offer them as remuneration. Because of this, the compensation office will now have more work to complete.

Conclusion

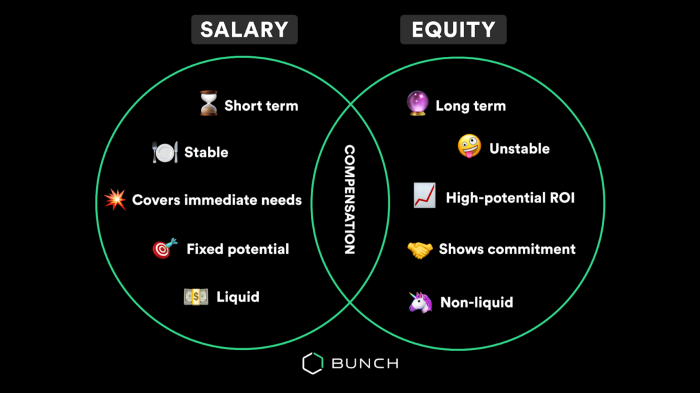

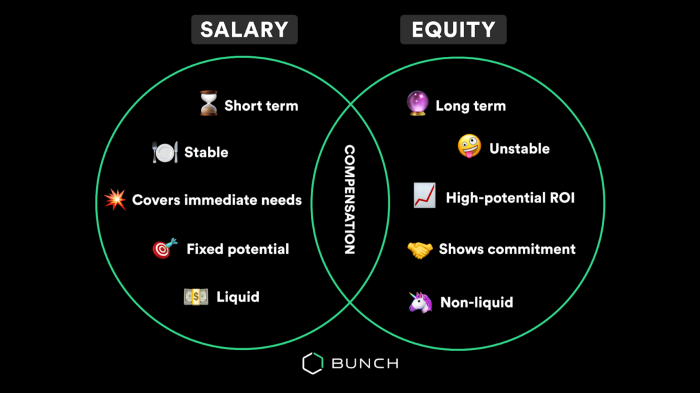

In some cases, employees receive equity compensation and base pay. All forms of "equity pay," including option grants, restricted stock, and performance shares, provide workers an ownership stake in the business. Equity compensation is occasionally combined with salary reductions. Many private and public organizations, especially startups, provide stock compensation to their employees as a benefit.