Introduction

The most recent sales prices of assets comparable to the one being valued serve as the basis for this method's valuation. The prices of recently completed transactions are recalculated to account for any differences between the assets sold and the assets being appraised, particularly in terms of the quantity, quality, and size of the assets. It is common to practice completely removing outlier comparables from the analysis or making significant adjustments to their results. This is because outlier comparables may have been influenced by unique factors that do not apply to the target asset.

When To Use The Market Approach

A market-based methodology is frequently utilised in the process of valuing real estate. It is also possible to estimate the value of privately held companies if no publicly traded shares are available. For example, a real estate agent can get a market-based assessment by gathering data on local real estate sales and adjusting those prices to account for differences in land area and building square footage.

How The Market Approach Works

As its name suggests, the market approach seeks to answer the question "what is the fair market value of this asset?" by analysing current market conditions. To conclude, the appraiser needs to investigate recent transactions involving assets analogous to the one in question. Several adjustments will need to be made to account for the fact that these assets are not likely to be identical to the one that is being appraised.

Because there is typically a great deal of information readily available in certain markets, such as residential real estate or publicly listed shares, the market approach can be easily implemented in these arenas. In other markets, such as the markets for shares of private companies or alternative investments like fine art or wine, it cannot be easy to find comparable transactions in the market in question. When there is a lack of information, an appraiser may be forced to rely on the cost approach or a discounted cash flow analysis (DCF).

Market Value Approach To Business Valuation

The market value method is used to determine a company's value. This method considers the impact of both the present and the past state of the market, as well as the similarities and differences between the company in question and the businesses that are used as comparables. Comparable situations can be found in the preceding transaction that involved the same company, the transfer of ownership of a comparable (public or private) company, and a market quote of listed securities of a comparable public company.

All of these can serve as examples. An estimate of the company's valuation can be arrived at by multiplying the price by the relevant financial statistic about the business being evaluated. The technique of market value can be further subdivided into two distinct categories, the first based on the source of comparable valuations and the second based on the process used to arrive at an estimated value.

Market Approach Methods

Public Company Comparables

The Public Company Comparables Method uses measurements from publicly traded companies that are reasonably similar to the subject company. It does this by comparing the subject company to other companies. The vast majority of publicly traded companies are not only more significant than the issue at hand, but they are also very dissimilar to it in various respects, making it difficult to achieve direct comparability. To ensure that publicly traded companies with similar business characteristics are not automatically disqualified from providing input on the subject company's value, there needs to be some wiggle room built into the direct comparability criteria.

Precedent Transactions

The Precedent Transactions Method determines the value of the subject company by utilising pricing multiples derived from the transactions of other companies operating in the same industry as the subject company. It is predicated on the idea that even though specific information regarding a company's financial situation might be difficult to obtain, the transaction value is easily accessible.

What Are Common Issues That Arise When Using The Market Approach?

Particularly problematic for privately held companies is the lack of reliable, comparable data that is generally available. Because private corporations are not required to publish annual financial reports, it may be more difficult for you to obtain financial information about a private company than it would be with a public company. This is because public corporations are required to make this information publicly available. Another problem with market-based approaches is that there aren't enough businesses comparable. If the target company specialises in the production of ice resurfacing machines, there may not be many businesses comparable to it (Zambonis). Because there is so little data readily available, putting the market strategy into action might be difficult.

Advantages

- Math skills only at the very basic level are required.

- It makes use of information that is both authentic and easily accessible.

- It does not depend on our projections in any way.

Disadvantages

- In most cases, there is a shortage of pertinent precedent businesses or business deals.

- It lacks the flexibility of other possible approaches when compared to those alternatives.

- The procedure raises concerns regarding the quantity as well as the quality of the data that is available.

Conclusion

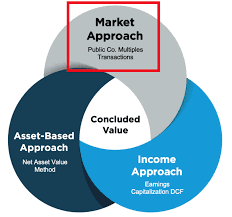

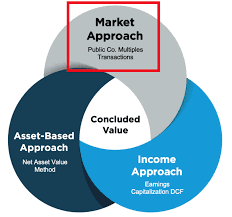

The market approach is frequently used whenever the value of something needs to be estimated. Along with the cost method and the discounted cash-flow analysis, it is one of the three approaches that are utilised the most frequently (DCF). The market approach is very effective when there is a significant amount of information available regarding previous transactions that can serve as a basis for comparison. As a result, it is possible that in the absence of such information, it will be necessary to resort to other methods.