Introduction

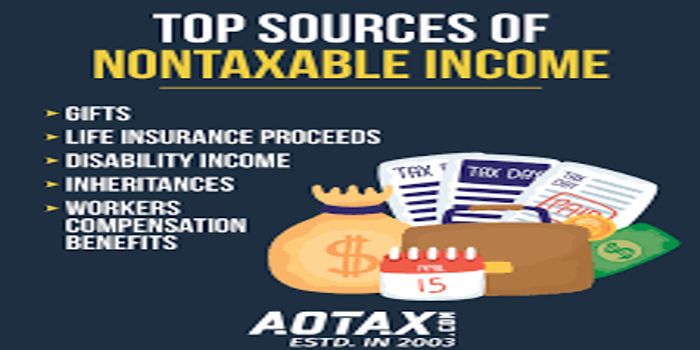

You won't be taxed on nontaxable income, whether or not you record it on your tax return. The following are exempt from taxation according to the Internal Revenue Service:

- Bequests, inheritances, and gifts

- Refunds for purchases made through a retailer, producer, or dealer

- Child support obligations (for divorce decrees finalized after 2018).

- Money is given as child support to a parent.

- Best available medical insurance

Expenses associated with adoption that qualify for reimbursement include government assistance in the form of welfare. The following things might not be taxed in certain circumstances. TurboTax offers advice on what to include in your tax return. The money you get as a death benefit from a life insurance policy is not taxable. However, the proceeds are frequently taxed when a life insurance policy is paid in. If specific conditions are met, scholarship money is exempt from taxes. However, the portion of the stipend utilized for expenses like rent or transportation is normally taxed by the IRS.

Disability Insurance Payments

Your benefits are taxed if your employer pays a portion of the cost of your disability insurance. The following are exceptions to the general rule that most disability payments are taxed:

Any benefits provided to you by a private insurance provider over and beyond those provided by the group disability plan of your employer. Private disability insurance premiums paid are tax deductible. Benefits of employee compensation. Damages for bodily harm (but not retaliation) cover expenses like hospital costs and missed pay. At the same time, a person recovers from an illness or accident, physical disfigurement, the loss of a limb, or the inability to use a body part permanently, government benefits for disabilities. No-fault auto insurance disability benefits for missed wages or lowered earning potential.

Tax-Free Home Sale Gains

Selling your primary residence and excluding (not paying federal income tax on) up to $250,000 in gain for an individual or $500,000 for a married couple filing jointly is one of the best methods to save money on taxes. There are limitations, just like with anything else. You must perform well on the next four exams to be accepted. Establishing ownership You must have owned the property for two out of the five years before the sale date. Conduct a test. You must have lived there permanently as your principal residence for two of the five years that you owned the property (periods of ownership and use need not overlap).

The Analysis Of Joint Filers

Checkout after an earlier acquisition. You must wait at least two years to do so again if you've previously excluded gain from the sale of your primary residence. If you and your spouse are filing jointly, the $500,000 exclusion is only available if neither of you has used it for another transaction during the previous two years.

Some Canceled Debts

It is possible to exclude from gross income debt cancellations that occur in connection with bankruptcy, insolvency, qualifying farm debt, debt connected to a qualified real estate firm, as a gift, or for buying a primary dwelling. Consult IRS Publication 525 to get all the details.

Support For Energy-Saving Initiatives

Your electric company gave you a rebate because of the considerable amount of energy that updating your air conditioning system will save you each month. The money you get as a "thank you" for buying or installing energy-efficient fixtures in your home is typically excluded from taxes.

Municipal Bond Earnings

The interest you get on bonds issued by state and municipal governments is typically not taxed by the federal government. Additionally, the interest on municipal bonds purchased in your state is often not subject to local taxation. (Learn the fundamentals of investing in bonds.)

Employee Achievement Award

It's a typical practice not to count the value of any award for sustained service or safety achievement that you get in the form of tangible personal property (i.e., something you can hold in your hands). However, due to your employer's expense, you are only permitted to deduct up to $1,600 in total for the entire year. Your business must present the reward meaningfully to avoid the impression that it is just a form of hidden remuneration. Yes, tangible personal property must be omitted to avoid taxes on the money, gift cards, and similar items—even if they are given for the same reason as the lovely painted ceramic dog you received.

Conclusion

You can be eligible for some tax credits under federal and state law, even though most of your income is probably taxed. Some states have different systems for taxing personal income, and other states have none. Municipal bond interest and Roth IRA withdrawals are examples of top sources of nontaxable income investments.